State

Referendum Measure 90

Kids need comprehensive sex education in schools. This makes it part of the curriculum. The main things are that the new law mandates teaching consent, teaching about abuse, teaching about healthy relationships, and include sexuality beyond Christian hetero only-in-marriage sex.

When I was in school, I got none of that. Not from school, not from my parents. Sex and relationships were taboo subjects.

In the mid-00s, I was a mentor for a program at Chief Sealth High School. One of the weeks the program had us separate into sex-segregated groups to talk frankly with the teens about sex. Those of us who were mentors could talk about our experience. The students could talk about theirs, and ask any question they wanted.

One example (details are generic to protect the kids): a young man asked about anal sex and immediately another young man exclaimed “that’s gross!” Almost all sex is kinda gross. That started a conversation about being gay, how not all gay men engage in it, anal sex in hetero relationships, basic facts about anal sex doing it safely. And even we didn’t didn’t get into consent and social pressure.

Another example (also details generic): another young man expressed that he was waiting until marriage and that he wanted a wife who was “pure”. Then we got to get into how it’s just fine to wait until marriage, but also how to respect other people (particularly women) and not slut-shame those who aren’t waiting.

Just a couple of examples. The young men at least had a giant hole of knowledge that comprehensive sex education could have filled. Just starting education on affirmative consent alone could begin a culture change where men don’t learn it’s okay to ply women with alcohol until their guard is down, or think the way to go is to keep pressuring until there’s a grudging acquiescence.

Is this going to solve all our misogyny around sex? Not hardly. But it’s a start.

Even the kids who do what conservative parents tell them and wait until marriage are gonna learn a lot and end up with much more amazing sex lives in their marriages because of this.

Vote Approve. Referendums are a bit weird. Remember that Approve means you want the law to stay on the books. Reject means you don’t want kids to get comprehensive sex education in school.

A buncha advisory votes

I always vote to maintain these. Fuck Tim Eyman.

Engrossed Senate Join Resolution No. 8212

A state constitutional amendment to allow money for long-term care services to be invested more broadly. I’ve voted for similar measures in the past, but this one isn’t a big deal either way.

Approved

King County

Charter for Justice Amendment 1

Charter Amendment #1 would:

- Require an inquest when a death occurs in a King County detention facility.

- Require an inquest when an action, decision, or possible failure to offer appropriate care by a member of a law enforcement agency might have contributed to a person’s death.

- Require King County to assign an attorney to represent the victim’s family in the inquest proceeding.

One of the things we learned from previous killings by police is that our inquest process is too limited. Specifically, it’s limited to the killing itself, not to the actions that police take leading up to the killing. An officer, through intentional action or negligence, can create the situation that leads to the death. Our inquest procedure didn’t consider those actions, decisions, or failures to provide appropriate care.

King County Executive Dow Constantine instituted some inquest reforms so they could. Seattle police promptly sued, saying that the wording of the charter allows only considering the circumstances of the death itself. That’s debatable, but rather than leave that up to the courts we can just make the charter clear that an inquest covers everything around a law enforcement involved death.

Yes.

Charter for Justice Amendment 2

Removes restrictions on the county’s authority to transfer, lease, or sell property if used for affordable housing.

Back in the 1990s, King County merged with Metro, assuming Metro’s transit and wastewater treatment functions. The county also assumed the restrictions on Metro that kept it from doing other non-transit non-treatment government work. It made sense for Metro property to not be used to set up housing because Metro didn’t know how to run housing. As part of a larger entity, that restriction hobbles King County from creating more affordable housing using its property.

Yes.

Charter for Justice Amendment 3

Replaces the word “citizen” with “public,” “member of the public” or “resident” within the county charter.

The only place where “citizen” should be used is for voting. For everything else, everyone should have the same rights as far as King County is concerned. For instance, charter section 260 establishes an Office of Citizen Complaints. It would become the Office of Public Complaints in the Charter.

Yes.

Charter for Justice Amendment 4

In 2015, King County voters established the civilian Office of Law Enforcement Oversight (OLEO) to investigate, review, and analyze conduct of county law enforcement. However, at the moment they don’t have access to much of the information they need to conduct investigations. This amendment would give OLEO the power to subpoena witnesses, documents, and other evidence relating to its review and investigations. Any subpoenaed witnesses would have the right to be represented by an attorney.

If you want to know why this is needed, read the article published this morning by the South Seattle Emerald. King County OLEO commissioned an investigation into the Sheriff’s Office investigation of Tommy Le’s killing. For reference, Tommy Le was shot in the back by KCSO deputies who claimed Tommy Le had a knife. Then later they quietly admitted there was no knife. Still they got to investigate themselves, using lots of bad investigation practices. OLEO looked into that.

Sheriff Johanknecht did not allow some of her deputies to be interviewed.

OLEO needs subpoena power.

Yes.

Charter for Justice Amendment 5

Returns the office of sheriff to an appointed position, to be appointed by the King County Executive and confirmed by the King County Council. Requires community and stakeholder engagement throughout the appointment process.

In the 90s, King County made the Sheriff an elected position. There are a number of good arguments that an appointed position is better. If we have a Sheriff who isn’t doing a good job, they can be replaced more than once every 4 years (recall requires malfeasance). It means that the Sheriff position will be filled through a competitive process, rather than hoping we get a good candidate. It means we can hire an outsider to clean up. It means that deputy union money can’t be used to elect themselves their preferred boss.

It means that the negotiation of the contract with the deputies union will be conducted by the King County Executive rather than the Sheriff, who has in every case but one since the position became elected, previously been a member of the deputies union. That’s a pretty big conflict.

It doesn’t remove all influence of the deputy union, but it does limit it and redirect it so it has to go through the King County Executive.

Yes.

Charter for Justice Amendment 6

Removes language from the 1996 Republican amendment that prevents alteration of sheriff’s office duties. Gives King County Council the authority to establish the duties and purpose of the Department of Public Safety. Enables King County to explore more effective public safety, rooted in community-based alternatives rather than the traditional criminal legal system.

Right now, if we wanted to take traffic enforcement and move it to another department, we could not do that. If we want to have a mental health response unit, it has to be under the control of the Sheriff currently.

Our King County Council is way more responsive than any of our sheriffs have been in a while. The council holds regular public meetings, for instance, where the public has the right to participate. The Sheriff does not have to hold any public meetings, nor consider any input from the public, when setting policies.

Yes.

Charter for Justice Amendment 7

Adds the following to the county charter anti-discrimination clause, which applies to county hiring and county contracts:

- status as a family caregiver. (won’t be able to discriminate against people caring for kids or parents)

- military status (won’t be able to deny a contract to someone because they need to be deployed)

- veterans who have been discharged for being gay or trans. (the Trump regime has been discharging trans people again, sometimes dishonorably)

Yes.

King County Proposition 1

Harborview is great. More of it please

Approved

Federal

President and Vice President

Get the wanna be dictator out of here.

Joseph Biden and Kamala Harris

US Representative District 7

Pramila Jayapal is a progressive rock star. Craig Keller is a dickweasel who sues to fuck over immigrants. In the 7th, he doesn’t stand a chance.

Be a winner vote Jayapal.

State

Governor

In one corner, we have Jay Inslee, who has done a pretty good job even though he isn’t so great on climate or progressive taxation.

In the other corner, we have a racist, science denying, sex abuse forgiving, law-breaking, neo-fascist Trumpist who wants to kill 2.4 percent of Washington state.

This one is an easy one. Jay Inslee

Lieutenant Governor

Officially there are two contenders, Marko Liias and Denny Heck.

There is also an effort by Joshua Freed to get people to write his name in for Lt. Governor after he got trounced by Republicans for being insufficiently racist or anti-science. Mind you, he’s still an absolute dickbag who promoted unsafe health practices in the face of Covid-19. But let’s talk about Joshua Freed’s corruption. One campaign finance rule is that a candidate can’t give a campaign loan to themselves and repay more than $6,000. Freed loaned his campaign $500,000 in September 2019 (with a loan agreement even). Then he paid himself back $450,000 in January. When that was flagged as against the law, the campaign reclassified the transaction as a $500K donation and a $450K return of a donation. He eventually agreed with the PDC that he’d violated campaign finance law and agreed to pay a $25K penalty, with another $25K to be paid if he violates the law again.

Voting for Joshua Freed is voting for fraud.

Marko Liias is a state senator for the 21st LD, which covers suburban areas from Edmonds to south Everett. Denny Heck is a Congressman from the 10th Congressional district, which covers Tacoma. If you read their web sites, they support a lot of the same things.

The first thing to note is that while Marko Liias has generally supported Sound Transit, he tried to absolutely fuck over the agency this session. There were a lot of complaints last year that the valuation schedule for taxing cars used to pay for Sound Transit was “unfair” to owners of older cars. As the owner of an older car at the time, I didn’t think much of that complaint, but ultimately i didn’t care much if the legislature changed it and funded Sound Transit some other way. Marko Liias was the sponsor of the bill that would have changed the valuation schedule. His bill did not replace the funding that was lost. Luckily, it did not pass.

However, Liias has also been very upfront about how George Floyd’s murder and recent protests have changed his mind about policing. Neither he nor Heck are really supporters of “defund the police”, but Liias does want to redirect funds from overpolicing to community based alternatives. Both support minor police reforms like prohibiting choke holds or purchasing surplus military equipment. Liias says he supports oversight on police union contracts, but his web site does not say to what extent.

Both have been supporters of marijuana legalization. Denny Heck has sponsored bills in Congress to end the prohibition on banking by marijuana businesses.

Marko Liias is gay. Too my knowledge we haven’t yet had a statewide executive officeholder who is gay. One of the bills he sponsored that passed was a ban on conversion therapy.

Marko Liias is 28 years younger than Denny Heck. We do need to start getting the next generation of politicians in office. We need a deep bench of experienced left-ish politicians. Particularly since there is a better than zero chance that Jay Inslee will take a position in the Biden administration, and the Lieutenant Governor will serve a couple of years as acting governor.

At this point, I’m leaning toward Marko Liias. But it’s not a deep commitment.

Secretary of State

Kim Wyman isn’t one of the more horrible Republicans, but she’s still a Republican in the time of Trump. She opposed the Washington Voting Rights Act and she opposed same day voter registration. She opposed King County moving to prepaid ballot envelopes because it wouldn’t be fair to other counties. Wyman opposed HR 1, a bill in Congress that would establish federal standards for elections and ban voter suppression and gerrymandering. She wanted more ID requirements to vote.

Kim Wyman will probably count ballots fairly, She’s been an effective administrator. But she won’t use her position to see that more people can vote and have that vote counted.

Gael Tarleton was elected twice to be Port of Seattle Commissioner, and 4 times to be 36th LD Representative. She has business and electoral experience. She supports improving campaign finance, and importantly, she supports increasing access to voting.

Voting Tarleton.

Treasurer

Duane Davidson is the incumbent. He got the job because in the open primary in 2016 there were 2 Republicans and 3 Democrats split the vote. The 2 Republicans split 48.5% and the 3 Democrats split 51.5%. But because the two GOP candidates only had to split their party’s vote 2 ways, they went through to the general. Where the Trump supporter won.

Mike Pelliciotti’s main issues as a state legislator have been accountability and transparency, and those are what we need in a state treasurer.

Has Duane Davidson done a poor job? Not really. But he has been raking in banking PAC donations, probably in the hopes of the banks that the Treasurer will use their investment services. All Republicans need to be voted out. The party needs to be burned to the ground and the earth salted. Moderate conservatives can start themselves a new party and build it up free from the taint of Donald Trump. All the good Republicans (like Chris Vance) left the party. What’s left are Trump’s bootlickers like Davidson.

Voting Mike Pelliciotti.

Auditor

This is also an easy one. Pat McCarthy has been a mostly good auditor, and previously was Pierce County Executive. A good auditor is one who is quietly going about their business and preventing problems before they happen.

Chris Leyba has been a police auditor at Seattle Police and King County Sheriff’s Office (though he doesn’t live in either place), positions that don’t require supervision of other people. And if you read his campaign Facebook, it’s typical GOP grievance politics (government waste! masks! liberals!) that don’t inspire any more confidence in his skills. He longs for a state electoral college!

And Pat McCarthy is a Democrat. I’d need a compelling reason to vote for anyone who stayed in the party of Donald Trump. By compelling I mean something like McCarthy butchers teens in a shed at the back of her property.

Voting McCarthy.

Attorney General

Incumbent Bob Ferguson has sued the Trump regime 80 times. In the cases that have been decided, he has 35 victories and 1 loss. 44 cases are still being decided. These cases range from overturning the ban on Muslims to an injunction preventing the Post Office from delaying election mail. He doesn’t argue these cases personally. He hires really good lawyers who know what the hell they are doing. If we want to keep fascist Republican fuckery at bay, Bob Ferguson is our man.

He’s also made sure to go to court on other issues like consumer protection. He’s sued and won against landlords who violated the Covid-19 eviction ban, and ticketing companies that kept money after events were canceled because of Covid-19.

He’s defended a number of initiatives successfully. I’m happy he got I-1639 upheld. Not so happy he was able to defend I-976 in superior court. Luckily he lost at the Supreme COurt. But if you think he’ll shirk his duties because he disagrees with a law, think again.

Matt Larkin has so far lied about his job experience (said he was Spokane prosecutor when he was not), fluffed his experience working as a Pierce County prosecutor, and now thinks that being the in-house lawyer for his own family’s business is enough to qualify him to be Attorney General. The fartnozzle also would fight the governor’s common sense orders to keep Covid-19 from killing even more people than it has.

Voting Ferguson.

Commissioner of Public Lands

In this case (unlike a lot of other statewide races), the GOP candidate Sue Kuehl Pederson actually has the qualifications to be Lands Commissioner. She has an undergrad in biology and a masters of public administration, and worked for Seattle City Light, Grays Harbor PUD, and the Army Corp of Engineers in environmental and resource management roles.

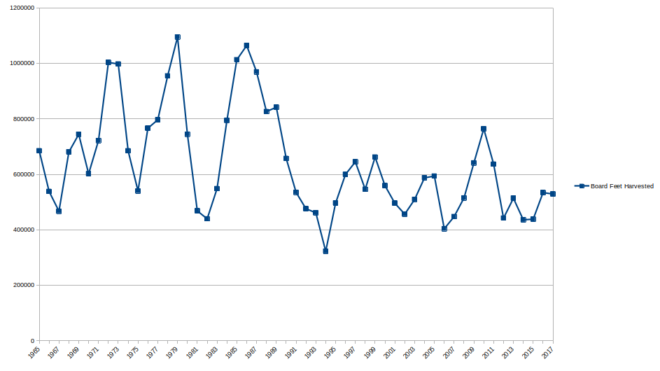

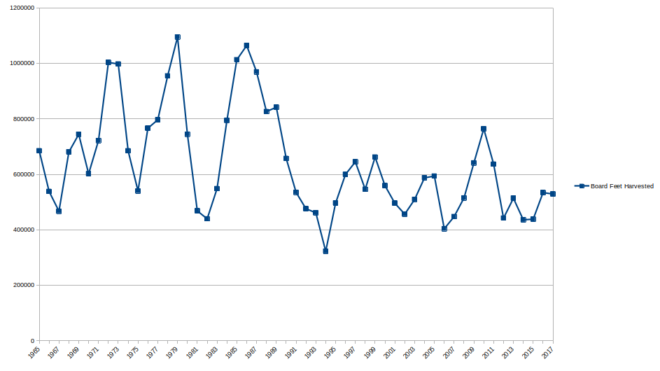

However, she’s a climate science denier and thinks that returning to clear-cutting practices of the 1960s will reduce wildfires. She accuses Hilary Franz of not letting logging companies log. Which is sort of true, but it’s not new with Franz. We log somewhere between 50 and 66 percent of the board-feet that we did in the 1960s and early 1970s, and require things like buffer strips between logging and rivers. Franz was Commissioner only for the last point on the graph below.

Hilary Franz’s position is that climate change is what’s driving the devastating forest fires. Drier lands means harder to control fires. Her department created a Forest Health Strategic Plan with stakeholders to plan for reverse unhealthy forest states and plan for climate change. There’s a lot of other good stuff Franz has done, but Pederson wants to make it about “rebuilding our logging industry” (aka clear-cutting) and I can’t get on board with that. Thing is, I think we’re going to need to rely a lot on mass timber construction in order to fight climate change, but the timber has to be harvested responsibly, not with frenzied abandon.

Hilary Franz:

- not a climate change denier

- not a clearcutter

- not a Republican

Voting Franz

Superintendent of Public Instruction

To be honest, I don’t know a whole hell of a lot about what Chris Reykdal has done as SPI, but I know he’s been catching a lot of flak as a proponent of the recent law (which is also on the ballot as Referendum 90) which mandates comprehensive sex education in schools. I’m a proponent of that law, so more power to him.

Maia Espinoza is a lying liar. One of the first things I did when I looked at her campaign web site was check her executive experience. She’s the Executive Director of the Center for Latino Leadership, which she’s been claiming is a federal 501(c)3 non-profit. But when I looked it up, it turned out it isn’t. Apparently even the state registration was “inactive” until a reporter called her about it. She also claims she has a masters degree, but she hasn’t graduated yet. She’s the second Republican in these races to have lied about their qualifications. And if you need a policy reason to dislike her, she wants to take money way from public schools and give it to charter schools.

Anyway, vote Reykdal and vote approve on referendum 90.

Insurance Commissioner

Mike Kreidler has served 5 terms as insurance commissioner, 1 term as a US Representative, 16 years in the state legislature, is a doctor of optometry, and served in the Army as an optometrist as well as having experience in a number of things not related to health care.

On experience alone, vote for Mike Kreidler. But Mike Kreidler has also been an excellent regulator of insurance in Washington State. He made sure that coronavirus testing is covered by insurance. When the Trump regime remove insurance protections for transgender people from Obamacare, Kreidler sent letter to all health care insurance in Washington reminding them that those protections are part of Washington state law and must be continued. He added a special enrollment period for the pandemic so people without health insurance had another opportunity to sign up. That’s all this year, and I’m not even covering everything.

The following two paragraphs are from Spokesman-Review coverage of the race.

[Chirayu] Patel, who describes himself as an “autistic savant” in campaign literature and interviews, also has some unusual ideas he hopes will win over voters. If elected he’d share the duties of the office with Kreidler and Anthony Welti, the Libertarian candidate eliminated in the primary. He’d apply the principles of organic chemistry, which he studied at the University of Washington, to the insurance industry.

He’d rely on his connections to the minds of Ronald Reagan and Thomas Jefferson – with whom he says he shares a common ancestor in Genghis Khan – to help guide him in office. He said in a recent interview he’d set a new requirement for insurance policies that cover expensive items like rare paintings, upping the premium and requiring that policy holders have a military tank to help protect them.

I honestly don’t know how this dude beat out a reasonably intelligent Libertarian with money in the primary, even as bad as Libertarians are.

Vote Kreidler.

LD 43 Representative Position 1

Leslie Klein is a frequent GOP sacrificial lamb, mostly in the 36th LD. Nicole Macri has been another progressive rock star in the state legislature. She almost got us county-wide funding for low-income housing. She had a remarkable 8 bills pass this biennium and get signed by the governor where she was the primary sponsor. She had a bunch of other bills that didn’t make it like the housing bill, one to loosen zoning restrictions statewide, secure scheduling, and a ton more. Klein isn’t even raising money and won’t be elected. Be a winner and vote Nicole Macri.

LD 43 Representative Position 2

I am pretty fed up with Frank Chopp. His positions are fine, but he spent many years as Speaker of the State House. That job is to make sure the legislation that comes up doesn’t hurt the overall Democratic majority. In other words, if a bill to raise taxes that would fund housing in the 43rd comes up, but it’s tough for a Democrat in Whatcom County to vote for it because the electorate there is more conservative, it’s the Speaker’s job to quash it or water it down or something so that the WC Rep doesn’t have to take a position that gets them voted out.

Chopp stepped down as Speaker a year ago, and I hoped that would unleash him to be a fierce advocate for the 43rd. That didn’t happen. For instance, while he nominally supported Nicole Macri’s bill that would allow King County (and only King County) to raise taxes to fund housing for people experiencing homelessness, he was never quoted in one article about it that I could find. If he was arm-twisting behind the scenes in support, it remained behind the scenes.

Or take funding for public transportation. Ideally, we’d have a graduated income tax and a graduated wealth tax to fund stuff. But we don’t, and when Seattle needed revenue to fund bus service (our Transportation Benefit District, which funds Metro service in Seattle), the legislature only allowed us to use a sales tax and/or a vehicle registration fee. I-976, may it forever burn in hell, fucked that royally. In January, when we didn’t know what would happen with I-976, the legislature did *nothing* to allow us to replace the revenue with another source. Folks like state senator Joe Nguyen worked their butts off to get a capital gains tax (and failed), but Chopp was nowhere to be seen. And the thing is, Chopp stood in front of the 43rd Democrats in January and told us the legislature would not roll over to I-976.

So now if you follow Chopp’s twitter, he’s got a new progressive revenue proposal, he’s all about putting limits on police unions, etc. etc. Where the fuck were you for so damn long?

This isn’t to say Frank Chopp hasn’t done anything ever. He touts getting earmarks for low-income housing, getting Sound Transit to sell off properties to housing orgs, and getting Apple Health funded. And that’s something. He’s done a lot, over the years.

A person who introduced Jessi Murray at a campaign event this spring said: we really need a representative who is going to bring enthusiasm and row like hell. That’s not been Frank Chopp. I’d hoped it would be Jessi Murray, but it was not to be. She came in third in the primary. Loved her platform.

As it is, I also love Sherae Lascelles platform. They’re the person who beat out Murray. Lascelles is a founder of POC Sex Worker Outreach Project and the Green Light Project, both of which do harm reduction efforts in Seattle’s sex worker community. And unlike Frank Chopp’s non-profit work (which is great!), Lascelles work is not what you’d think of as high level executive director stuff. They’re out on the streets in the evening delivering supplies to sex workers and asking them what they need to survive, then trying to help them do just that.

One of the things sex workers needed was hand sanitizer. And when the pandemic hit and supplies of that dried up, Lascelles started Hygiene Hustle, a company that manufactured sanitizer. They both sell it and give it away to people on the street, including both sex workers and rough sleepers. Lascelles comes from a background of mutual aid.

As a Black, queer, non-binary, poor person who works delivering mutual aid to sex workers, Lascelles has a pretty good view to how policing has not helped many people. They’re an advocate for decriminalizing sex work, for instance. Lascelle’s organizations have been part of the Decriminalize Now coalition that, along with King County Equity Now, were the prime drivers of the 3 demands from protests against policing in Seattle this summer: defund the police by 50%, invest the money in community responses, and don’t prosecute protesters. Lascelles wasn’t the only person behind that, but they were a key person.

As a candidate for State Representative, Lascelles supports things like progressive wealth taxation, comprehensive bias training for police, zoning reform, funding public transportation, and more. Importantly, Sherae promises that their platform will be a living document, always being worked on in consultation with the people who are most in need.

Lascelle’s “theory of change” is to use pressure from constituents to drive change in the legislature. By that, they want to leverage on the ground groups to rally support from legislators for bills. Chopp’s methodology is to lean on legislators he helped elect. (That’s from a candidate forum both attended.) I’m less opposed to leveraging relationships in that manner than Lascelles is, but the drawback to backroom deals is there isn’t a lot of accountability involved.

So, despite the fact that I do not match any of the identities that describe Lascelles, nor do I share a socialist ideology, I will be enthusiastically voting for them. They have the experience and a mindset that is sorely needed in the Washington State Legislature.

Voting Sherae Lascelles.

State Supreme Court

Governor Inslee appointed both Raquel Montoya-Lewis and G. Helen Whitener to replace retiring judges within the last couple of years. Montoya-Lewis is Native American, and Whitener is a Black lesbian. And of course, it’s the justices from marginalized backgrounds that drew opponents, both of them conservative white men. The two white justices up for election are unopposed.

David Larson uses the dog whistle “the constitution as written” in his candidate statement. All justices look at the constitution as written. It’s the conservatives ones who use that phrase to signal that they’ll interpret it as enshrining how we looked at people years ago forever, “if the people who wrote it thought we could discriminate, then that’s the interpretation we have to go with!” Screw that.

Richard Serns, as best as I can tell, hasn’t even worked as a lawyer despite graduating law school years ago. Instead, he used his legal training as a school administrator for decades. Which is great! We need people who understand the law working in those positions. But he did that work as an administrator, not as a lawyer. He doesn’t have the experience.

Both G. Helen Whitener and Raquel Montoya-Lewis have oodles of experience as judges at the superior court level and in Montoya-Lewis’ case as chief judge for several tribes. I’m voting for them.

King County Superior Court

Judge Position 13

Andrea Robertson has more experience as a trial lawyer and she has experience as a public defender. Two of the attorneys she worked under are now judges, giving her a leg up in legal mentorship.

Hilary Madsen isn’t a slouch, but she did a stint as a King County Prosecuting Attorney Trial Fellow. She did represent defendants in immigration court, and it’s not like she is a candidate espousing a crack down hard mentality.

However, we need way more judges who came up through the ranks as a public defender than we need those who did time as prosecutors, so I’m voting for Andrea Robertson. But this may be a bad decision.

Judge Position 30

Doug North has been a judge for years and years. But about 5 years ago he said a pretty racist thing from the bench. He got sanctioned and had to go through sensitivity training. He seems like he’s truly sorry for it and has learned something. But… where there’s one bias there’s likely to be others. And there’s no way a week or two of sensitivity training has helped him clear those biases.

Carolyn Ladd is a corporate attorney for Boeing. But she’s a really good attorney and she does a lot of work to advance women in the field. And some less visible things. Former City Council candidate Melissa Hall does clinics for transgender Seattleites to get their documents changed with new names and correct gender descriptors and anything related. Hall relates that Carolyn Ladd came to those clinics time after time to serve as a notary. She saw a co-worker at Boeing have a tough time getting their paperwork fixed and decided she wanted to help make that easier.

Voting Carolyn Ladd.

Seattle

Proposition 1

In 2015, Seattle voted to create a transportation benefit district funded by a 0.1% sales tax and $60 vehicle license fee. The money has been used to “buy” bus service from Metro for Seattle routes. That expires at the end of the year.

Proposition #1 is the replacement. Just a 0.15% sales tax and no vehicle license fee (due to I-976, even though it’s overturned). The money will fund every 10 minute bus service on core routes like the 70, 49, 7, 3 etc. It may not be quite as frequent as before because there’s less money in this proposition than the previous one. If we want to do something about climate change besides reshare quotes from Greta Thunberg, we need to move to public transportation and fast.

Voting yes for public transportation.